Business support hub

What are you looking for today?

Filter by

Accounts

Agriculture

Audit / assurance

Business recovery

Construction / Property

Charities / NFP

Cloud accounting

Corporate finance

Hospitality / Leisure

Payroll

Personal debt

Tax services

Wealth management

TC blog

TC news

Scots AUTOSCENE magazine – Business Funding

In the latest edition of the re-branded SMTA magazine Scots AUTOSCENE (formerly Auto Insight), we pair up with the team at Breadalbane to discuss various business funding options for company owners.

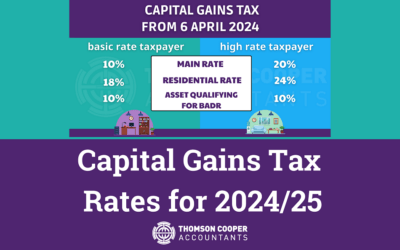

Capital Gains Tax Rates for 2024/25

Capital Gains Tax (CGT) is raises billions for the UK Government every year. Here we look at the some of the key aspects of CGT and the current rates applied to both basic and high rate taxpayers.

How to reduce your Inheritance Tax liability

Understanding the implications of Inheritance Tax (IHT) is essential for effective estate planning. With careful preparation, you can ensure your beneficiaries receive their maximum inheritance while minimising any tax due.

Child Benefit – higher earners restart their claims

Due to a change in the 2024 Spring Budget, many couples with a high earner may need to restart their child benefit claims as charges have been reduced for 180,000 families.

Charity Newsletter Spring 2024

Welcome to the latest edition of our charity newsletter featuring issues that affect the third sector including annual return changes, the impact of AI and the Spring Budget.

Tipping Code of Practice for Employers

The new Tipping Code of Practice for Employers will require many business owners in the hospitality, leisure and service industries to review the way they record and distribute tips, gratuities and service charges.

How to work smarter using online accounting software

Online accounting software is constantly being developed to help business owners work smarter and streamline their processes. Are you aware of all that your online accounting software can do for you? Are you using the features to their full extent? Our guide highlights some of the key advantages.

Step Challenge Success for Worst Pace Scenario

Step Challenge success for Worst Pace Scenario as Thomson Cooper teams record over 12.5 million steps in only 28 days.

Window on Wealth Spring 2024

Welcome to the latest edition of our Window on Wealth Spring 2024 wealth management newsletter. This edition is packed with articles covering many of the key wealth management challenges and questions currently facing savers and investors.

Downloadable guides

Airbnb share data with HMRC about the earnings of those who let out property on UK platform

November 9, 2020