Welcome to our Window on Wealth Autumn 2024 wealth management newsletter. This edition is packed with articles covering many of the key wealth management challenges and questions currently facing savers and investors.

Tax services articles

How to avoid a business horror story

We learn how SME business owner Fraser has a business horror story when he loses a key member of his finance team and things spiral out of control. But help is at hand in the form of an outsourcing team.

Journal Entry Autumn 2024

Welcome to the latest edition of our business newsletter Journal Entry. Our ‘Retirement’ edition bids a fond farewell to Senior Partner Andrew Croxford and provide ideas on retirement and succession. We also cover a recent scam, Xero pricing changes and how the markets can be impacted with a change of Government.

How to budget for entertaining (and avoid a tax penalty)

Be budget aware and don’t entertain a tax penalty when it comes to entertaining clients or rewarding staff. Your budget might not stretch to a ticket to the Euros or a trip to the Olympics but whatever you choose, allowable deductions could make your budget go further.

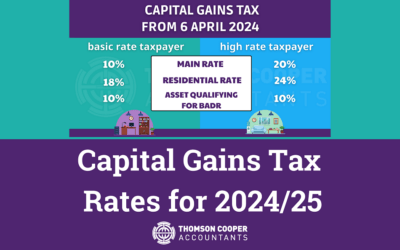

Capital Gains Tax Rates for 2024/25

Capital Gains Tax (CGT) is raises billions for the UK Government every year. Here we look at the some of the key aspects of CGT and the current rates applied to both basic and high rate taxpayers.

How to reduce your Inheritance Tax liability

Understanding the implications of Inheritance Tax (IHT) is essential for effective estate planning. With careful preparation, you can ensure your beneficiaries receive their maximum inheritance while minimising any tax due.