Read our update on the recent changes announced by HMRC regarding their suggested reimbursement rates for employees using a company car for private travel.

Tax services articles

Extracting Profits from a Limited Company

When extracting profits from your limited company you need to be smart to avoid paying more tax than you need to. Our personal tax planning specialists cover the basics here.

How to account for R&D tax credits

Although R&D credits are a valuable resource for your company, they do require some specific accounting processes. Here’s how you should go about it.

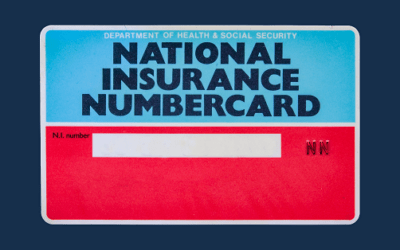

How do changes to NICs affect you when you’re self -employed?

This article explains how National Insurance contributions thresholds have changed for self-employed people, and what this means in terms of when and how much should now be paid.

Can I reduce my tax bill?

Employees, self-employed or owners of limited companies; landlords and investors, here are some ideas to help reduce your tax bill and make the most of the schemes and allowances on offer.

The end of the road: ready to exit your business?

How to extract your hard-earned cash in a tax efficient way when considering retirement plans or an exit strategy.