Best of both worlds or out of range – do the numbers stack up for Hybrid & Electric Cars?

With the impact of climate change still fresh in our minds following the recent COP26, a new initiative to reduce city centre vehicle emissions is getting into gear.

Scottish Low-Emission Zones (LEZ) for passenger vehicles are scheduled to start in Spring 2022 in Edinburgh. The LEZ limits vehicles in central city areas to low-emissions vehicles only.

Vehicles not meeting the defined criteria will be expected to pay a charge to offset their emissions. Using Automatic Numberplate Recognition (ANPR) cameras, the zones will be monitored and automatic charges made.

There will shortly be road markings and signs denoting where the zones begin and end. Failure to comply with the new rules could result in fines being levied. To help people adjust there will be a two-year ‘grace period’ before penalty charges are issued. Enforcement is due to start from the 1 June 2024. Exemptions for blue badge holders and some vehicle types will also be in place with more information available on this website – https://www.lowemissionzones.scot/

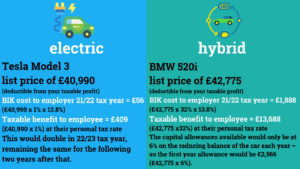

To aide in the swing towards low emissions hybrid and electric vehicles, the Benefit in Kind (BIK) rates for employees with these vehicles are more attractive now, in comparison to petrol and diesel cars.

In the current 2021/22 tax year, fully electric vehicles have a BIK rate of 1%, and will increase to 2% in the 2022/23 tax year, remaining at that rate in 2023/24 and 2024/25.

For hybrid vehicles, the number of miles that can be travelled on the electric range of the vehicle determines the rate of the benefit of the car. For all non-electric/hybrid vehicles, the BIK rate is still based on CO2 emissions. The BIK for a vehicle is based on the list price of the car (including any optional extras/upgrades) and not what you paid for the vehicle.

https://www.gov.uk/guidance/company–car–benefit–the–appropriate–percentage–480–appendix–2

Charging Points

There is no taxable benefit in kind to employees for charging their vehicle at an electric charging point at work. This applies for both business and personal mileage. However, if a charging point is provided by the employer at an employee’s home, then a taxable benefit does arise based on the cost to the employer for providing this.

Capital Allowances on Cars

For new and unused cars bought from 6 April 2021 that are fully electric, you can claim the full cost of the vehicle as a First Year Allowance. For example if the vehicle cost £50,000, the £50,000 would be deducted from your taxable profit. It should be noted that the First Year Allowance is separate to the Annual Investment Allowance – therefore, the Annual Investment Allowance is still available for tax relief over and above the First Year Allowance.

For non-electric cars, the capital allowance rate is based on CO2 emissions – so if you are considering a hybrid vehicle it is worth checking the CO2 emissions rate on the car to see what allowances would be available. The rate of writing down allowances applicable to a car are either 18% or 6%. The 18% and 6% rate also applies to all second hand vehicles.

Click here for an example of how an electric car compares to a hybrid. – hybrid vs electric car comparison

If you need further information regarding this scheme, please email info@thomsoncooper.com.

Thomson Cooper www.thomsoncooper.com

3 Castle Court, Carnegie Campus, Dunfermline Tel 01383 628800

22 Stafford Street, Edinburgh Tel 0131 226 2233