Saving vs investing – Should I keep my money in the bank now interest rates are high?

As a financial planner the most common question I have been asked during our client meetings over the last few months is ‘should I keep my money in my bank account now that the rates are high?’

Up until recently, borrowers have ‘enjoyed’ low rates of interest in their mortgages and loans. However, because of a low interest rate environment, savers have suffered from next to zero returns from their savings.

Until now that is. With a high interest rate and high inflationary environment, institutions are offering fixed term deposit accounts with the highest rates in decades available of up to 6% if you are willing to lock the money away for a few years.

Given the mostly negative returns in investment portfolios during 2022 (particularly so-called cautious portfolios which include fixed interest assets such as gilts and bonds), the benefit of a 6% interest rate return seems attractive in the short term particularly. However, it comes with its own risks.

What are the risks of having your savings in cash?

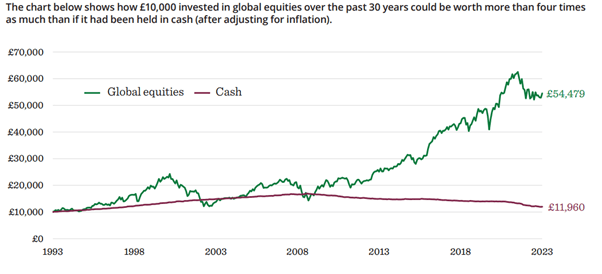

Locking up your cash – If you come out of an investment to go into cash (e.g. a bank or building society savings account), you are no longer invested in assets which, over the long term, have historically beaten inflation. You may miss those periods where investments rise sharply which can have a significantly detrimental effect on long term returns, as seen by the chart below.

Source: Quilter investors as at 30 June 2023. Total return, adjusted for inflation, in pounds sterling over period 30 June 1993 to 30 June 2023. Based on an initial investment of £10,000. Global equities is represented by the MSCI All Country World Index and cash is represented by the Bank of England Base Rate. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into an index.

Source of chart: Quilter ‘The Impact of Inflation’

Tax – The Personal Savings Allowance is a tax-free allowance which allows you to earn interest on your savings before you pay tax. The allowance you receive differs depending on your rate of income tax. The first £1,000 of savings interest that basic rate taxpayers earn and the first £500 for higher rate taxpayers is free from income tax. The higher interest rates are therefore bringing more people into potentially having to complete tax returns and pay tax than before.

Inflation – Inflation, also known as the price of goods and services, has averaged around 2.5% in recent times but, as with interest rates, we have seen a sharp increase and a peak of 11.1% (Office for National Statistics August 2023) in October 2022. As of July 2023, the rate was 6.8%.

This level of inflation can have a hugely destructive effect on your savings, particularly over the longer term. For example, if inflation is at 7%, the real value of £10,000 over three years is £8,163 (source Quilter Investors as at 30th June 2023). Therefore, a cash account with a 5% return is, in truth, suffering a real loss over the longer term.

Conclusion

A sound financial plan should always include cash for short term emergencies and capital expenditure. However, investing in the medium to long term in a well-diversified portfolio offers a chance to mitigate the effects of inflation if you can stomach the ups and downs of the markets.

Of course, professional advice should always be sought. For more information, contact Senior Financial Planner Gary Stirling at gstirling@thomsoncooper.com.

The information contained within this article is for information only purposes and does not constitute financial advice or recommendations. Thomson Cooper cannot assume legal liability for any errors or omissions it might contain. The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested. The past is not a guide to future performance and past performance may not necessarily be repeated.