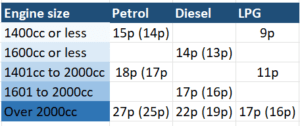

HMRC has announced their suggested reimbursement rates for employees using a company car for private travel. The suggested rates apply from Thursday 1st September 2022 and are summarised in the table below. Rates for previous quarters are shown in brackets (where there has been a change). Remember that the fuel benefit does not apply if all private fuel is fully reimbursed by the employee/director.

If the employer’s policy is that they do not pay for any fuel for the company car, these are the amounts that can be reimbursed to the employee (for qualifying business journeys) for payments to be tax-free. You can continue to use the previous rates for up to 1 month from the date the new rates apply.

Please note that for hybrid cars you must use the applicable petrol or diesel rate, and for fully electric cars the rate is 5p per mile.

Employees using their own car

Where employees use their own car for business journeys, the tax-free reimbursement rate continues to be 45p per mile plus 5p per passenger. Despite lobbying, this rate has not increased for nearly 10 years! Note that the employer can reclaim input VAT on such payments based on the figures in the above table. For example, if an employee drives their own 1500cc car for business journeys and is reimbursed 45p per mile, then 18p per mile is deemed to represent the cost of petrol. The employer may claim 3p per mile (1/6) as input VAT, provided the employee submits a fuel receipt to support the claim.

If you need further information regarding these changes, get in touch with our tax team at info@thomsoncooper.com. We are here to support you.